how are rsus taxed in california

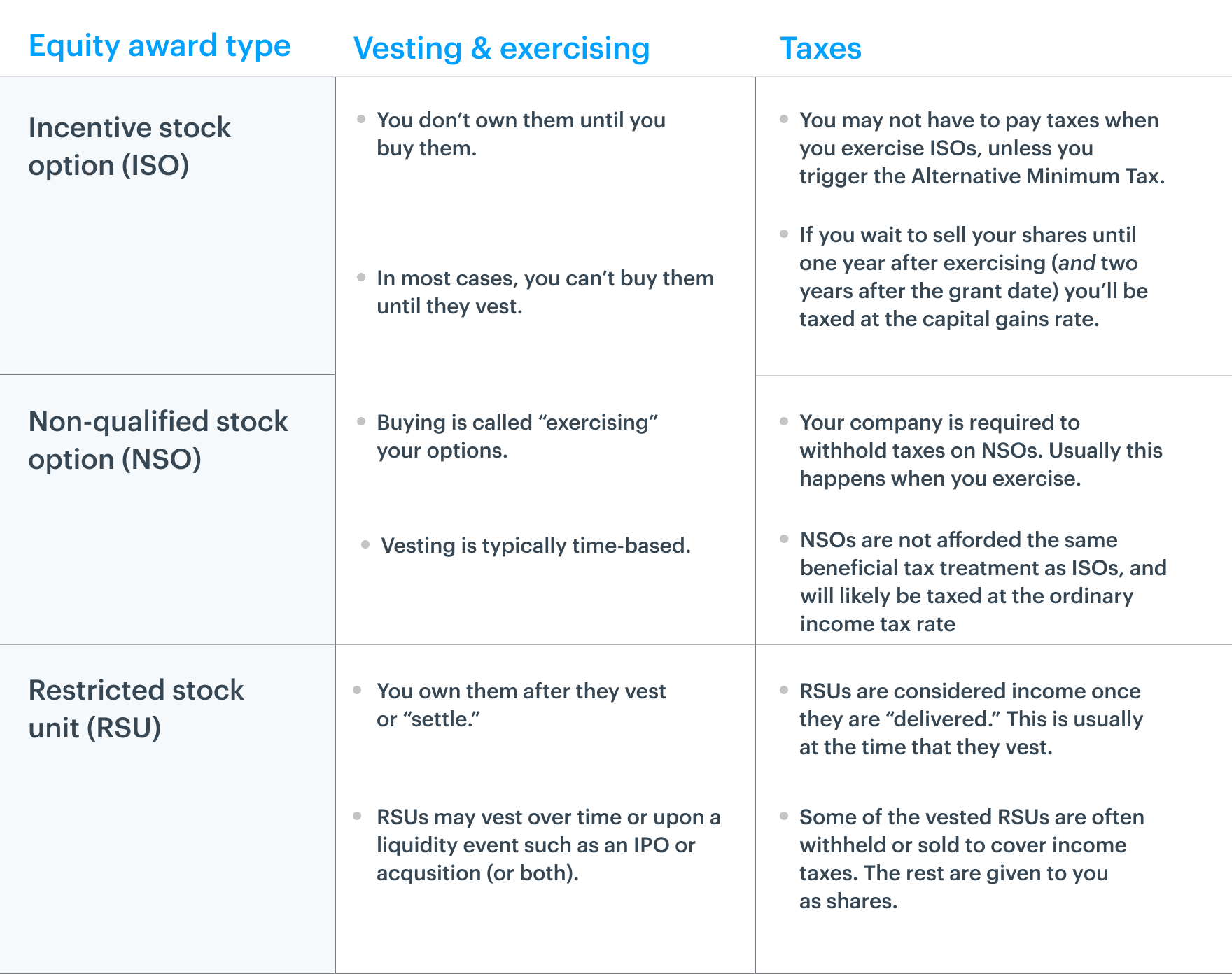

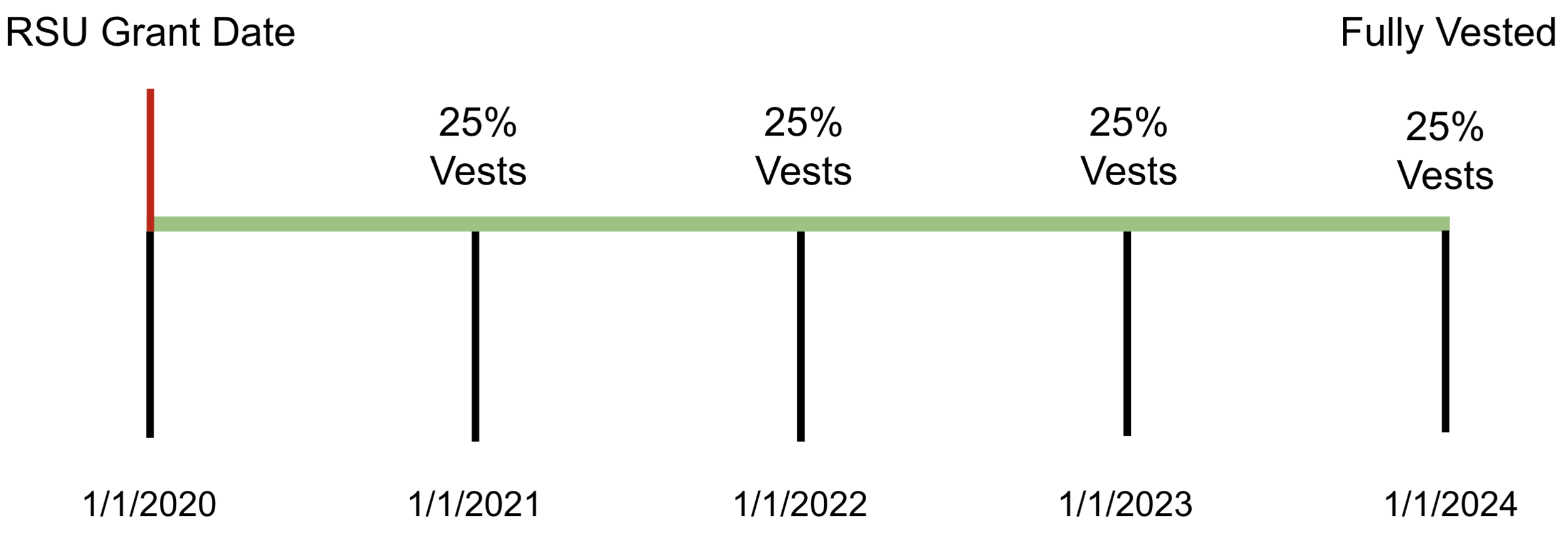

Here is how RSUs are taxed. Upon vesting the shares are considered income for the employee.

The Mystockoptions Blog Tax Planning

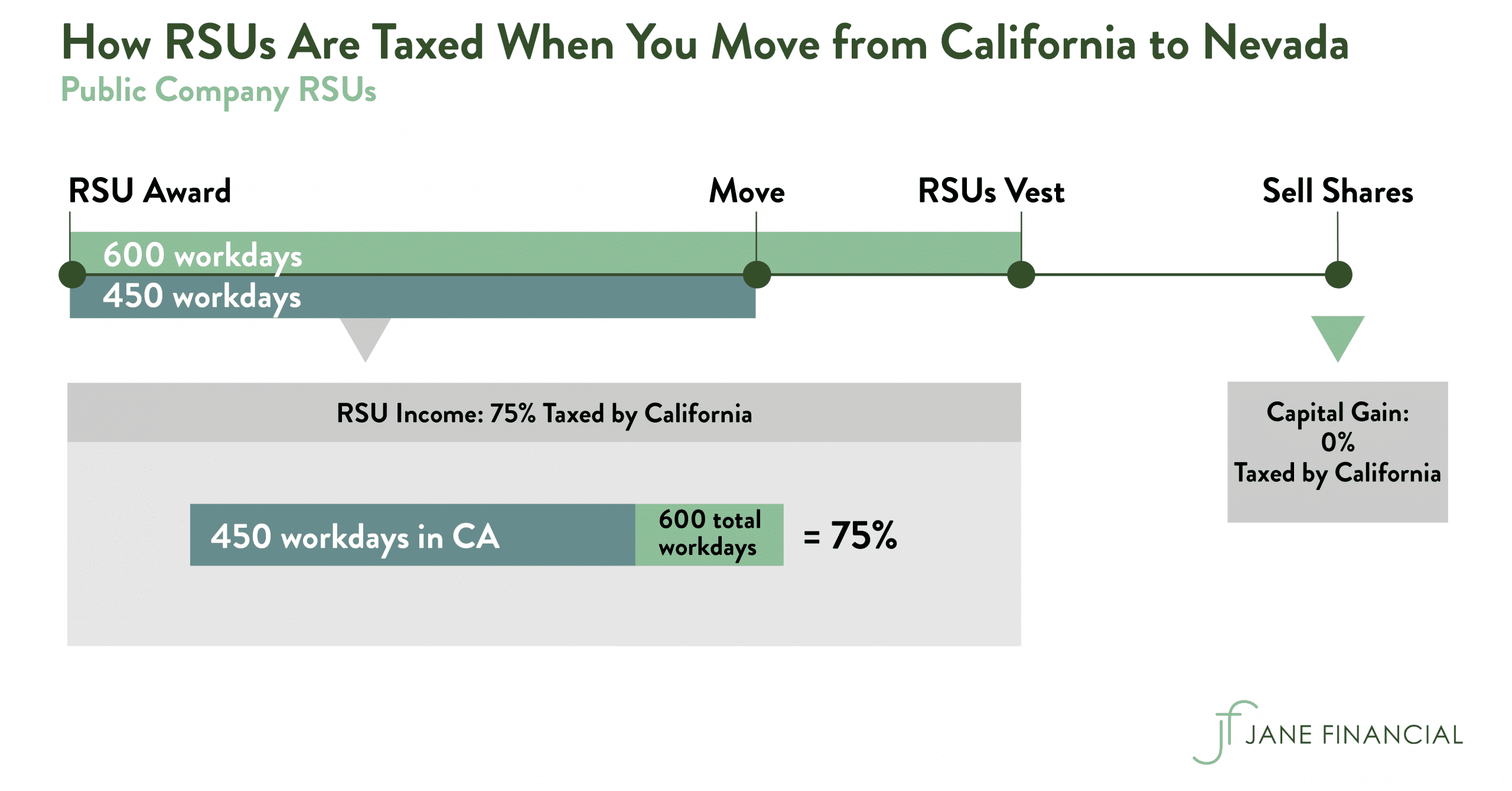

However if you moved out of California before the Vest date.

. If you lived in California the entire buying period then the Bargain Element on the sale is fully taxable in California. Upon vesting they are considered income and a percentage is withheld to pay taxes. Californias Office of Tax Appeals issued a non-precedential decision on the states taxation of restricted stock units RSUs affirming the Franchise Tax Boards grant-to-vest.

Lets say one year has elapsed and you receive 30 shares of company stock of the 120 RSUs originally granted 25 per year vesting schedule. When you sell your shares any capital gains are taxed as ordinary income in California. In some states such as California the total tax.

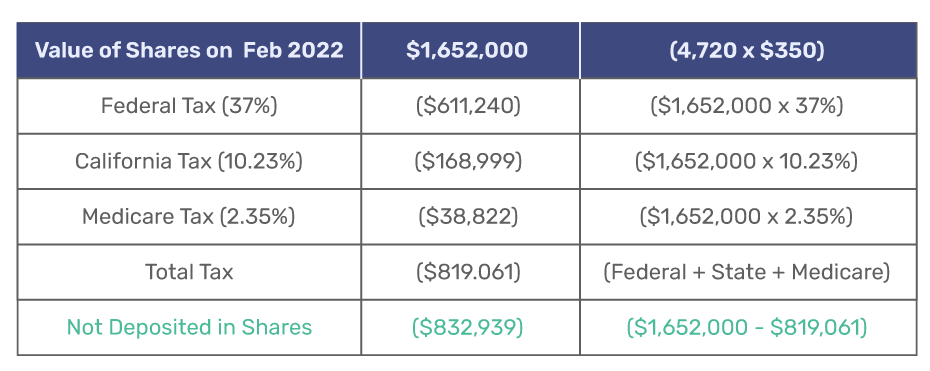

Theyre taxed as ordinary income - so its based on your marginal tax bracket. Lets start with how taxes on Restricted Stock Units typically work. At the time that these RSUs are received by the taxpayer part of them are actually sold to offset the tax withholdings and some tax withholdings are paid using the proceeds.

The value of over 1 million will be taxed at 37. As money becomes taxable to you your company sets aside money for you so that you can. With an all-in tax rate of 15 you only need to pay 150 for.

Once when you take ownership of the shares usually when they vest and again in another way when you. 6012 Your Monthly Take Home. RSUs including so-called double.

The remaining shares go to the employee. This doesnt include state income Social Security or Medicare tax withholding. If you sell your shares immediately there is no capital gain tax and you only pay ordinary income.

If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k. RSUs are taxed as income to you when they vest. As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs.

Capital gains tax is imposed only if the stockholder. How are RSUs Taxed. RSUs can trigger capital gains tax but only if the.

The employee receives the. The taxable income incurred on each vest is calculated as follows. Any RSUs earned during a marriage are.

RSUs generate taxes at a couple of different milestones. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. RSU income bonuses and sales commissions are a type of income called supplemental wages which are subject to a series of.

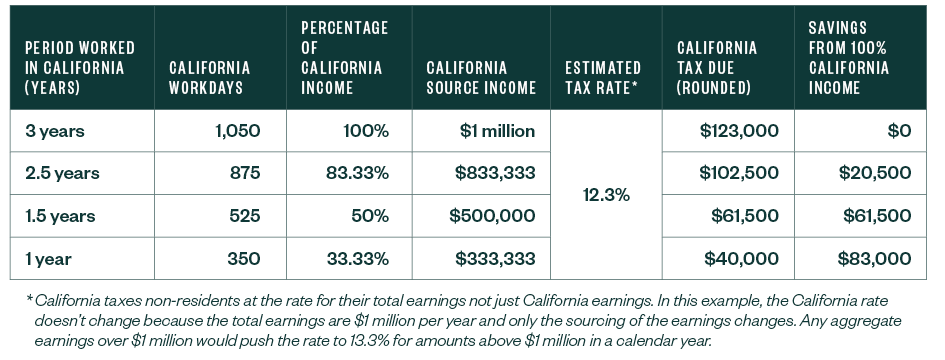

RSUs are generally taxable like salary when shares vest. For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income. Ordinary Income Tax.

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. As the RSUs vest the value is taxed as income. A percentage of the shares are withheld by the company for income taxes.

1023 or 1023 California Tax Withholding. With RSUs youre subject to California income tax when the shares are delivered to you. RSUs are taxed at ordinary income rates when issued typically after vesting.

California withholds 1023 as each RSU tranche vests.

Sheryl Sandberg S Restricted Stock Units Zoe Financial

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

Moving From California With Startup Equity Compound Manual

How Equity Holding Employees Can Prepare For An Ipo Carta

Restricted Stock Units 10 Fast Facts Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

14 Ipo Tax Strategy Ideas Stock Options Tax Strategies

Restricted Stock Unit Rsu How It Works And Pros And Cons

All About Rsus And Rsas Too Financial Planning Fort Collins

How State Residency Affects Deferred Compensation

When Do I Owe Taxes On Rsus Equity Ftw

Rsu Taxes Explained 4 Tax Strategies For 2022

Common Rsu Misconceptions Brooklyn Fi

Restricted Stock Units Jane Financial

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

Stock Options Vs Rsus What S The Difference District Capital

/Restricted-stock-unit_final-395366371dc24cfe939e0bc19c0b6102.png)

Restricted Stock Unit Rsu How It Works And Pros And Cons

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted