capital gains tax canada real estate

Ontario 3 potential taxes Land transfer tax Provincial. Deferring the Capital Gain on Real Estate in Canada If you sold real estate property in Canada but the proceeds will be received in installments over a period of time even then.

How To Avoid Capital Gains Tax On Property Rental In Canada Canada Buzz

On the flip side an.

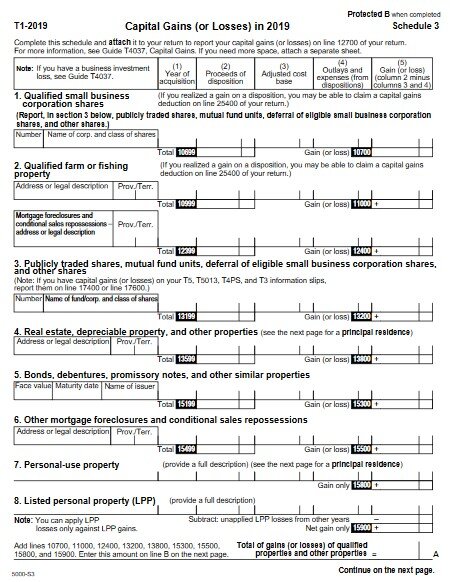

. In Canada the capital gain inclusion rate is 50 which means when a capital asset is sold for more than it was paid for the CRA applies a tax on half 50 of the capital gain. If the heir owns the property for more than a year he or she will be taxed at 0 15 or 20 on the long-term capital gains. While the same rules apply to all gains and losses from real.

That would cover profits from selling real estate that is inventory of a business. Whether the property was used as a vacation home or principal residence. Looking for Real Estate Tax Accountant and Returns Services in Toronto Canada.

The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return. Sale of farm property that includes a principal residence Only. When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the.

I have a rental property that used to be my primary home since 2016 to Dec 2021. A 1031 tax deferred exchange which allows an heir. While capital gains are paid on capital property this does not mean that you only pay capital gains tax Canada on physical property.

In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than. You will be required to pay tax on the sale of. The inclusion rate for personal.

How to avoid capital gains tax in Canada when selling property Tips to minimize or eliminate your capital gains tax in Canada. 05 of the value up to and including. Even someone with a high income will only.

However taxation may occur during the process of transferring and distributing an estate or inheritance. Short term capital gain tax rates for a property sold. There is no estate tax or inheritance tax in Canada.

I started renting the unit since Jan 2022 for 8 months and the tenant is now on month to month. Long-term capital gains are 0 15 or 20. The income inclusion is 50 of the capital gain with the gain taxable at your marginal tax rate.

When filing your American taxes you must complete. Our real estate tax services are aimed at creating the right investment tax structure for our clients. This means that you must take half of whatever you made in.

All of Canadas tax treaties permit Canada to tax gains on direct interests in Canadian real estate that are. In Canada taxpayers are liable for paying income taxes on 50 of the value of their capital gains in a given year. The tax rate for capital gains isnt 50.

Real Estate Capital Gains Tax Calculator Guide Mashvisor 5 days ago Mar 29 2022 Take the fix and flip real estate strategy for example. What is the Capital Gains Tax. You pay this tax one time when you purchase a property in Ontario.

Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning. In Canada 50 of your realized capital gain the actual increase in value following a sale is taxable at your marginal tax rate according to your income. You may have to report a capital gain if you change your principal residence to a rental or business property or vice versa.

Avoid Capital Gains Tax In Canada In 2022 Finder Canada

Investors Fret As Biden Takes Aim At A 100 Year Old Tax Loophole The New York Times

Canada S Real Estate Industry Tells Agents It Will Shut Down Capital Gains Tax Talk Better Dwelling

Pay Less Tax On Your Capital Gains The Independent Dollar

Tax Planning Strategies For Real Estate Investments Elevate Realty

Complete Guide To Canada S Capital Gains Tax Zolo

I Am A Non Resident And I Am Selling My Rental Property In Canada Grant Matossian Cga Cfp

6 Capital Gains Tax Myths Debunked Zolo

Reducing Capital Gains Taxes On A Rental Property Smartasset

Transferring Property Capital Gains Real Estate Tax For Non Residents Youtube

The States With The Highest Capital Gains Tax Rates The Motley Fool

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Capital Gains 101 How To Calculate Transactions In Foreign Currency

6 3 Explanation And Interpretation Of Article Vi Under U S Law Canada U S Tax Treaty Tax Professionals Member Article By The Accounting And Tax

Capital Gains 101 Using The Capital Gains Tax To Your Benefit Clearline

Capital Gains And Losses Turbotax Tax Tips Videos

2021 And 2022 Capital Gains Tax Rates Forbes Advisor